Real Estate Metrics: Cash on Cash Return

Written by Trifonas Mamas, MRICSUpdated 5 January 2023

If you are considering investing in real estate, it's important to understand the financial metrics that can help you evaluate the potential profitability of a property. One such metric is cash on cash return. Here's a breakdown of what you need to know:

- What is cash on cash return?

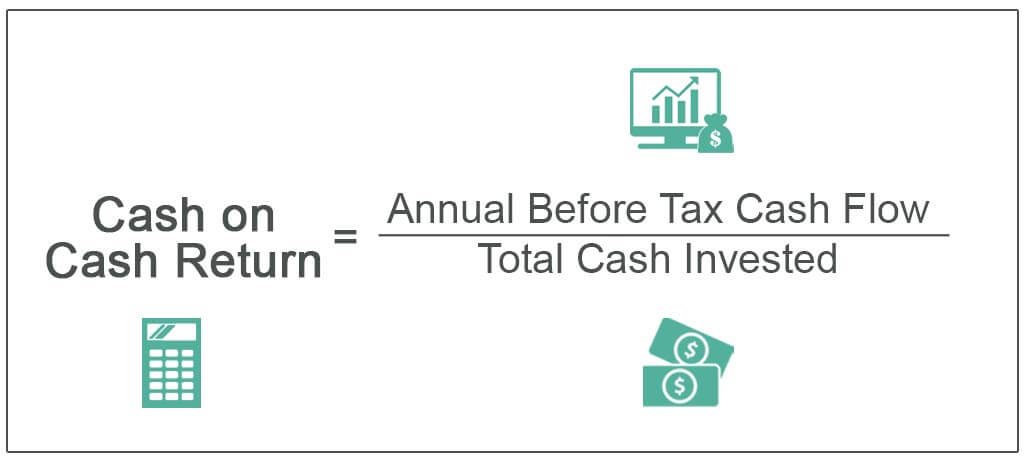

- Cash on cash return is a measure of the return that an investor can expect to earn on their cash investment in a property.

- It is calculated by dividing the annual before-tax cash flow of a property by the total cash invested in the property, and is expressed as a percentage.

- Why is cash on cash return important?

- Understanding the cash on cash return of a potential investment property can help you determine whether the investment is likely to be profitable.

- A high cash on cash return indicates that the property is generating a good return on your investment, while a low cash on cash return may indicate that the property is not a good investment.

- What factors impact cash on cash return?

- Financing of the property

- Rental income generated by the property

- Operating expenses associated with the property

- Potential for appreciation

Here's an example of how cash on cash return works:

- You want to purchase a rental property and take out a loan for €200,000.

- You make a down payment of €50,000 and secure a loan with a 4% interest rate.

- The property generates €20,000 in annual rental income and has operating expenses of €10,000.

- The cash on cash return for this property would be calculated as follows:

- Annual cash flow: €20,000 - €10,000 =€10,000

- Cash invested: €50,000 + €10,000 (estimated closing costs) = €60,000

- Cash on cash return: €10,000 / €60,000 = 16.7%

In this example, the cash on cash return for the property is 16.7%, indicating that it is generating a good return on the investor's cash investment.

Newsletter

Thank you for your submission!